Business theft has become one of the most expensive and disruptive operational risks in transportation, logistics, warehousing, and automotive storage. In 2025 the insurance landscape shifted again as carriers responded to a clear rise in organized theft, fraudulent pickups, yard intrusions, and identity based cargo crime. Operators who once renewed coverage with minimal friction are now facing higher premiums, narrower coverage, and more detailed loss prevention requirements.

The purpose of this report is to outline what insurers are seeing, why risk ratings have changed, and what facility level controls now matter most for maintaining insurability.

The State of Theft in 2025

Organized cargo theft continues to rise

Data from CargoNet shows a significant increase in coordinated theft activity. Activity is concentrated in transportation hubs, cross border corridors, high density distribution regions, and areas where gate processes remain manual.

Identity based cargo theft is a primary driver of losses

The National Insurance Crime Bureau reports continued growth in impersonation based theft. Criminal groups use forged identities, falsified carrier credentials, cloned company information, and fraudulent pickups to obtain access to freight and equipment.

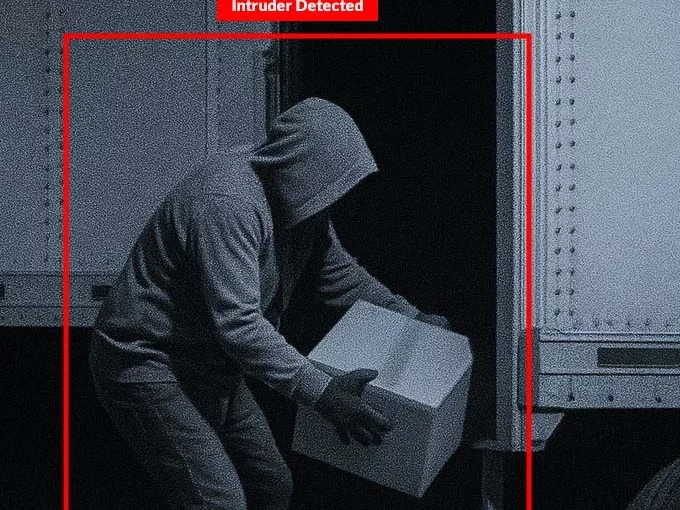

Targeting of yards and gatehouses has increased

Industry loss reports indicate that yards with inconsistent access control and limited perimeter oversight experience higher loss severity and more frequent claims. Common contributing factors include manual gate logs, guard turnover, lack of ID verification, and incomplete trailer and seal documentation.

Higher loss severity is affecting all sectors

The financial impact of a single theft event has increased due to load value growth, downstream disruption, regulatory reporting, and the operational cost of replacing equipment or inventory. Electronics, pharmaceuticals, retail inventory, automotive components, and food goods continue to rank among the highest loss categories.

Why Theft Insurance Is Harder to Obtain in 2025

Underwriters are prioritizing verifiable controls

Carriers now require objective proof of security practices. Verbal confirmation is no longer accepted. They expect recorded data, documented protocols, and continuous visibility of access points.

Examples of required documentation include:

• Verified driver identity records

• Video backed gate transactions

• Trailer number and plate logs

• Seal status with photographic evidence

• Time stamped yard entries and exits

Manual guard based processes create higher risk scores

Locations that depend on guard shacks, paper logs, or limited camera coverage are rated as higher exposure because these environments lack consistency, accuracy, and traceability. Human error and turnover are major contributors to denied claims and increased premiums.

Gaps in perimeter coverage affect insurability

Carriers increasingly ask whether the perimeter is monitored continuously and whether breaches trigger immediate intervention. Static cameras without active monitoring do not meet current expectations.

Insurers want transparency into operations

Underwriters are requesting information about:

• Gate wait times

• Throughput

• Driver verification steps

• Seal verification protocols

• Incident response procedures

Companies without structured oversight or accurate reporting face delays or coverage limitations.

What Insurers Expect to See in 2025

These are the criteria most commonly evaluated during renewals or new applications.

Accurate identity confirmation

Insurers want confirmation that only authorized drivers and carriers access the yard. This includes CDL verification, license plate recognition, and cross-matching of carrier information.

Birdseye supports this through real-time verification and logging.

Full visibility at the gate

Carriers expect proof that every gate transaction is captured. This includes truck and trailer identification, driver credentials, bill of lading information, and direction of travel.

Birdseye documents this with 99.99 percent accuracy

Continuous perimeter monitoring

The perimeter should be monitored at all times with the ability to detect and respond to intrusions. Unmonitored cameras do not meet this requirement.

Birdseye provides twenty four hour monitoring with rapid intervention

Documented trailer integrity

Carriers want to see seal status, seal numbers, and load condition recorded at entry and exit. Missing documentation can invalidate claims.

Birdseye logs and verifies seal information and load details

Incident reporting and safety compliance

Facilities must show that safety protocols are enforced and that incidents are logged accurately.

Birdseye enforces protocols across safety, operations, and security through YardOS

How Operators Can Strengthen Their Position Before Renewal

- Establish consistent gate procedures: Standardized workflows reduce variability and improve the completeness of your records.

- Establish consistent gate procedures: Standardized workflows reduce variability and improve the completeness of your records.

- Move away from manual logs: Paper-based systems are not defensible in claims and are viewed as unreliable by insurers.

- Implement continuous monitoring: Real time monitoring significantly reduces risk and supports the strongest insurance profiles.

- Capture and store objective data: Facilities that can produce accurate gate data, safety logs, seal records, and perimeter activity reports have a better chance of receiving competitive coverage.

How Birdseye Supports Operators in Meeting 2025 Insurance Requirements

Birdseye provides verified data, continuous visibility, and strict protocol enforcement. These capabilities align directly with the criteria insurers evaluate.

Bottom line

Theft insurance in 2025 is no longer focused only on loss recovery. It is centered on how well a facility prevents loss in the first place. Carriers expect verifiable data, continuous visibility, and strict adherence to protocols. Operators who can demonstrate this level of control are more likely to secure coverage at a reasonable cost.

Birdseye provides the data, visibility, and enforcement that insurers use to evaluate risk, helping operators protect their assets and maintain insurability in a high threat environment.